Entire Bio Katie Miller is often a shopper economic companies pro. She labored for nearly 20 years as an executive, main multi-billion greenback mortgage, credit card, and price savings portfolios with operations worldwide and a novel give attention to The buyer.

These added details permit our attorneys to realize a deeper knowledge of the specifics within your situation

Pursuing courtroom approval, the system ordinarily contains paying fastened quantities around a predetermined period of time, typically a few to 5 years. Chapter 13 bankruptcy can stay on your own credit report for nearly seven yrs.

Try to look for lenders that enable prequalification which has a comfortable credit score Test. You may check your acceptance odds and preview possible charges by prequalification with no further more hurting your credit rating score.

The information presented on our Web site about any lawful support service provider is sourced directly from the respective company's Web-site. Therefore, we can't assurance the accuracy or validity of the details. If you have any doubts about the main points on our website, we motivate you to definitely Make contact with the legal service supplier for confirmation.

“But It's important to establish that the debts or economic difficulties have been as a consequence of Serious conditions outside the house your control,” Morgan claims, “including the death of the husband or wife or divorce.”

HELOC A HELOC is often a variable-fee line of credit score look at this now that allows you to borrow money for just a established period and repay them later on.

In that context, you may well be entitled less than that Act (the "CCPA") to ask for the next as and also to the extent they implement to us:

By publishing this manner I conform to the Terms of Use and Privateness Coverage and consent being contacted see here by Martindale-Nolo and its affiliates, and up to three attorneys concerning this ask visit our website for and to receiving suitable marketing messages by automated visit this page suggests, text and/or prerecorded messages with the number delivered. Consent isn't needed as being a condition of provider, Click this link

BBB A+ Rated McAfee Safe sites assist continue to keep you Risk-free from identification theft, bank card fraud, spyware, spam, viruses and on-line cons

Bankrate.com is surely an impartial, promotion-supported publisher and comparison provider. We're compensated in exchange for placement of sponsored products and services, or by you clicking on specified back links posted on our site. As a result, this compensation may possibly affect how, exactly where As well as in what order products and solutions appear within listing types, besides in which prohibited by law for our house loan, household equity and also other household lending products.

We've been based in California and therefore can be issue for the California Shopper Privacy Act of 2018 even with respect to persons who pay a visit to our Site(s) from other places.

It is important to shop around which has a few lenders and deal with loans made available from negative credit lenders official source or credit score unions. Making use of for your automobile personal loan after bankruptcy can really feel daunting. And though it’s correct that getting a aggressive publish-bankruptcy auto bank loan usually takes excess leg operate, it continues to be achievable. That function involves checking and improving your credit rating and trying to get lenders with versatile eligibility requirements.

In-home financing: Motor vehicle dealerships can supply in-household financing for borrowers with negative credit score, which include people who have been by means of bankruptcy.

Michael Bower Then & Now!

Michael Bower Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Burke Ramsey Then & Now!

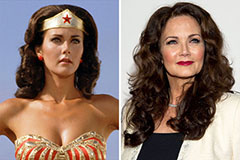

Burke Ramsey Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!